Understanding the Current Ethereum Validator Exit Queue: What Stakers Need to Know

Ethereum’s validator exit queue has reached historic levels, creating the longest wait times since staking began. For stakers, this moment is both a challenge and a reminder of the safeguards built into Ethereum’s design. At stakefish, we believe in transparency and want to inform stakers as to what’s driving the congestion, what it means for your stake, and how to plan ahead.

What’s Happening?

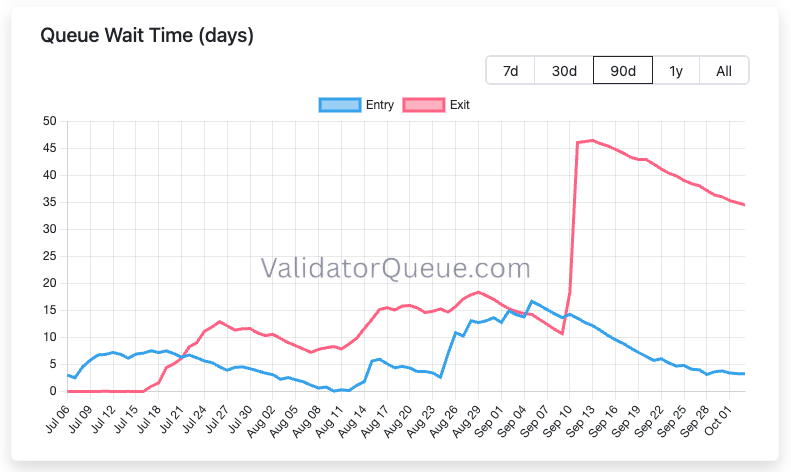

Over the past several weeks, Ethereum’s validator exit queue has surged to more than 2.6 million ETH, around $12 billion, awaiting withdrawal. The sharp increase was driven by large-scale voluntary exits, most notably when Kiln withdrew around 1.6 million ETH worth of validators following recent security-related concerns (including the SwissBorg breach and NPM supply-chain attack).

Because Ethereum limits the number of validators that can exit each day for security reasons, these mass exits have created an exit queue backlog of 34+ days. This is the longest exit queue in Ethereum’s history. For context, the network currently allows about 57,600 ETH per day to exit safely without jeopardizing consensus stability.

What This Means for Stakers

If you’re in the queue, your validators remain active and continue earning rewards until they fully exit. The withdrawal process happens in three phases:

- Exit queue: Wait time to leave active validation. Currently ~34+ days.

- Withdrawability delay: A fixed ~27-hour period (256 epochs) before funds can be swept.

- Withdrawal sweep: Validators enter the execution layer queue, where withdrawals may take up to 10 days during peak congestion.

Combined, this means a 6+ week timeline from exit request to final withdrawal under current conditions.

To keep up with the Ethereum validator queue you can visit validatorqueue.com

Why This Matters

It’s important to understand: these delays are not failures. They are deliberate security features. Ethereum’s consensus protocol is designed to slow down mass exits so that no single event can destabilize the network.

For individual stakers, that means:

- You still earn rewards during the queue period.

- Your funds remain secure within Ethereum’s withdrawal mechanics.

- Network stability is preserved, even during large institutional rebalances.

Many of the ETH exiting now are expected to be re-staked. Institutions often rotate validators, take profit, or adjust risk exposure, before re-entering the activation queue to continue earning.

Looking Ahead

With the backlog this large, elevated exit times will likely persist into October 2025 and beyond, depending on new exits and re-staking flows. The queue will gradually normalize as it clears at the daily churn limit, but stakers should expect multi-week waits for the foreseeable future.

If you’re planning liquidity moves or adjusting validator positions, factor in at least 6–7 weeks from exit to withdrawal. For long-term stakers, this period is less about disruption and more about Ethereum’s built-in resilience at work.

stakefish: Here to Support

As one of Ethereum’s leading validators, stakefish continues to operate with 99.98% uptime, industry-low commissions, and the MAX MEV smoothing pool to deliver consistent returns. Even during historic network congestion, our role remains the same: to secure Ethereum and maximize rewards for our delegators.

Reach out to stakefish support for personalized guidance on exits, validator operations, and liquidity planning.

Security Update: September 2025

Recent security incidents, including the NPM Supply Chain attack and SwissBorg breach, triggered large validator exits across the ecosystem. We want to reassure our community:

- stakefish services were not affected.

- All delegator assets remain secure.

- Operations continue without disruption.

Following the news, we conducted an additional review of our systems to validate the resilience of our infrastructure. Our security-first approach includes:

- Non-custodial by default : Stakers always control their keys.

- Defense in layers: Multi-cloud deployments, zero-trust access, hardened key management, and strict review processes.

- Operational discipline: Staged rollouts, conservative updates, and safety over speed.

- Ongoing monitoring: Active testing, simulation, and monitoring of attack scenarios.

Our mission is to secure the networks we validate and safeguard the stakers who delegate with us.

Conclusion

Ethereum’s historic exit queue highlights the strength of its design: stability even during extreme events. For stakers, it’s a reminder to plan around timelines while knowing your funds remain safe and productive. At stakefish, we remain committed to supporting Ethereum with transparency, resilience, and security so you can Stake. Earn. Relax.

About stakefish

Founded in 2018 by Ethereum and Bitcoin veterans, stakefish is the leading validator for Proof of Stake blockchains. With support for 20+ networks, we combine institutional‑grade infrastructure with intuitive dashboards, transparent reporting, and a spotless slashing record so individuals and institutions alike can stake confidently while strengthening decentralized networks.

Visit our website 🐠 | Telegram | X | Instagram | YouTube | LinkedIn | Reddit