Ethereum staking: In-depth guide on rewards & commission

stakefish, one of the world’s leading staking pools, simplifies the complexities of Ethereum staking while maximizing rewards. Our MAX MEV smoothing pool ensures consistent payouts and our transparent commission structure keeps you in control of your earnings.

Introduction

At stakefish, we are driven by the mission of decentralization and securing the blockchain. This mission started with our Founder & CEO, Chun Wang, whose experience in the industry goes as far back as 2013 as a co-founder of f2pool - one of the largest mining (PoW) pools for Bitcoin, and Ethereum (cointelegraph). stakefish began with specific goals for continuing the mission of Ethereum as it transitioned its consensus mechanism from proof-of-work to proof of stake.

Unique to Ethereum, reward, and commission structures are complex compared to other proof of stake blockchains. There are two types of rewards: a) protocol rewards, and b) execution rewards, with a total of 5 types of sub-rewards. The commission is not implemented at the protocol level, but it is implemented specifically by the staking operator. In this guide, we’ll help you understand the structure of different types of staking rewards and commissions for Ethereum staking.

Protocol rewards

Sometimes referred to as consensus rewards, the protocol rewards are for securing the network at the consensus level. It comprises 1) attestation rewards 2) block proposal and 3) sync committee rewards. Protocol rewards come from new issuance.

Issuance

The rewards derive from new issuance of ~0.52%. The opposite force to ETH issuance is the rate of which ETH is burned. For a transaction to execute on Ethereum, a minimum fee (known as a "base fee") must be paid, which fluctuates continuously (block-to-block) depending on network activity. The fee is paid in ETH and is required for the transaction to be considered valid. This fee gets burned during the transaction process, removing it from circulation. Ultrasound.money has a nice dashboard to see these forces.

All rewards are functions of the base reward, which is proportional to the number of total validators.

To simply put, the more validators there are staked, the more rewards (APR) are spread out. To understand this easier, below is the chart of estimated APR based on the total number of validators. Sometimes this is referred to as the network reward which represents the limit of your protocol rewards can attain. To see the real-time number of validators and network APR, see validatorqueue.com.

Types of rewards

- Attestation rewards - Every epoch (6.4 minutes) the validator must “attest” - to vote in favor of the validator’s view of the chain. Rewards are given for submitting attestations. A common way to measure this performance is to look at the effectiveness rate. Performance and reliability play an important role in maximizing this reward.

- Proposal rewards - Proposers are randomly selected validators that are rewarded for proposing the next block to the Ethereum network. Your chance to propose a block is proportional to the total number of validators, eg the more validators the higher the chances. Roughly it takes about 60 days for a single validator to propose. A useful tool here can help you visualize your chances. The rewards are relatively large.

- Sync committee rewards—A lesser-known reward type is the Sync committee, a committee of 512 validators randomly assigned by the Ethereum network every 27 hours (256 epochs). The committee's role is to sign the block header which is the new head of the chain of each slot. If chosen, the rewards are relatively large during the 27-hour period. Again, performance and reliability play an important role in maximizing this reward.

Execution rewards

A validator can also be rewarded for execution tasks each epoch. This reward is dependent on the transaction volume or the demand of Ethereum L1. It is directly related to the gas fees, and demand for inclusion, order from MEV.

Types of rewards

- Priority fee tips: The user pays the tip fee on the transaction to get prioritization from the validators to include it.

- Maximal Extractable Value (MEV)—Paid by users, mainly MEV searchers looking to capitalize on trading arbitrage and liquidation opportunities. MEV is a term used to encapsulate the profit a validator can make by including, excluding, and reordering transactions in the blocks they create.

Unique to stakefish, we provide a MAX MEV smoothing pool that collects all the fee/MEV and distributes it evenly to all users with a smart contract. We leverage major MEV relays to maximize your rewards. These relays, not limited, are: flashbots, bloxroute, blocknative, eden, ultrasound, and agnostics.

Most of our competitors, notably P2P, Kiln, or Allnodes, do not provide a smoothing pool. This means fee/MEV fluctuates at the same rate as your block proposals, which is a high degree of fluctuation. It may take 2+ months for a single validator to see any reward. In contrast to stakefish, you can collect the reward daily with the MAX MEV smoothing pool.

Commission

Not all commissions are the same. We’re here to give you the most comprehensive explanation on how they’re done. Unique to the Ethereum blockchain, the commission is not as simple as a protocol setting on other blockchains. Protocol rewards are automatically swept to your withdrawal address every 4-5 days. Fee/MEV rewards are paid to the fee pool address assigned by the staking operator. The commission is collected based on specific implementation by the staking operator.

Kiln - Charges 8% for retail, no smoothing pool. Kiln deploys a cloned contract to capture both the protocol rewards and execution rewards. They deduct the fees from there. While it is optimal to capture fees, it is not optimal for the user because the rewards and withdrawal do not go straight to your account without claiming from these contracts.

P2P - Charges 5% for retail, no smoothing pool. P2P deploys a cloned contract to capture the execution rewards. Based on an offline calculation from your protocol rewards and execution rewards, it generates a merkle proof (like an airdrop) and submits to the contract. The user then enters the exact value they’re eligible to claim and the merkle proof in order to get their remaining portion of fee/MEV rewards. This is better than Kiln because it does not touch protocol rewards directly, but lacks transparency due to offline calculation.

AllNodes - Charges fixed fee $240/yr, no smoothing pool. Allnodes lets you spin up your infrastructure like Amazon AWS and take full control of your protocol and execution rewards. A basic $5/mo plan without MEV relays (zero MEV) exists. However, users must pay $20/mo to gain MEV relays. With fixed fees, the commission fluctuates greatly because the rewards can fluctuate. At the time of writing (Sept 20, 2024), the Ethereum reward dropped significantly, pushing the commission to 8%.

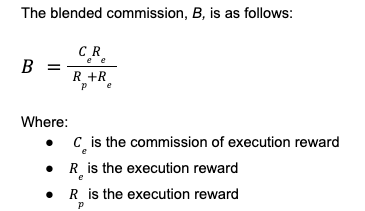

Stakefish - (BEST) Charge of 3.2% - 5% blended commission, which changes based on the 25% on fee/MEV smoothing pool.

- For protocol rewards, you retain full control of the withdrawal address and keep 100%, zero commission.

- For execution rewards, we have a MAX MEV smoothing pool contract that collects all of the fee/MEV from multiple relays (flashbots, bloxroute, blocknative, eden, ultrasound, and agnostics) into a shared pool.

- Fees are transparent and calculated on-chain. You can claim the fee/MEV rewards directly on your staking dashboard anytime.

To calculate the blended commission on both protocol and execution rewards, we collect the pool’s protocol reward rate and the fee reward rate over the past 30 days.

We built a Dune Analytic dashboard to help you understand the blended commission in real-time.

Staking

Stakefish provides the most powerful and friendly Ethereum dashboard in the industry. It’s engineered for the elite retail and tailored for small and large stakers alike.

- Classic staking: Ethereum staking with no contract risk, optimal gas, and stake as many as 100 validators in one go.

- Eigenlayer staking: Restake validators with Eigenlayer and generate re-staking rewards.

- Safe Multisig wallet: Connect with Safe wallet to securely stake with multisig wallet.

Collect Fee/MEV rewards

MAX MEV Smoothing pool means you don’t have to wait until a block proposal to collect rewards. All fees/MEV from the retail pool are collected to a smart contract and ready to be collected anytime.

Conclusion

stakefish, one of the world’s leading staking pools, simplifies the complexities of Ethereum staking while maximizing rewards. Our MAX MEV smoothing pool ensures consistent payouts and our transparent commission structure keeps you in control of your earnings. Whether you're a small or large staker, stakefish provides a reliable, user-friendly platform to grow your Ethereum staking with confidence.

Stake now at: stake.fish/stake