What Is Staking Crypto?

Cryptocurrencies have come a long way since the advent of Bitcoin. One of the latest innovations in the industry is called staking. This…

Cryptocurrencies have come a long way since the advent of Bitcoin. One of the latest innovations in the industry is called staking. This process allows you to earn rewards, just by owning crypto. In this article we provide a basic introduction to what staking means and how it works.

Staking is only available for certain types of cryptocurrencies. Some popular examples include Solana, Polygon and Polkadot. What sets them apart is the mechanism they use to maintain their networks.

Proof of Stake

A blockchain network relies on computers, called nodes, to validate groups of encrypted transactions, or blocks. These nodes are decentralized and independently operated. The network needs them to keep it running and node operators are incentivized to participate since they get rewarded, in crypto, for their work.

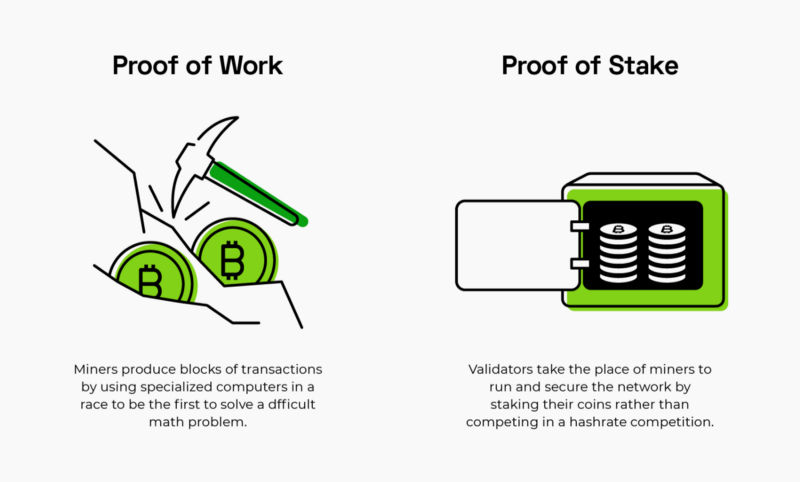

Proof of Stake is a consensus mechanism, or the way a blockchain network decides which node gets the right to propose and validate the next block.

In a Proof of Stake network, the probability of a node being chosen is proportional to their “stake”, or the amount it has in the native cryptocurrency. This is different to the consensus mechanism of the Bitcoin network, known as Proof of Work or mining, where nodes compete to solve complex mathematical problems with their computational power, or hashrate, to be able to validate the next block, making the process much more energy intensive.

In any case, operating a node requires technical knowledge and specialized equipment.

Staking Crypto

Staking allows anyone to earn part of the rewards from helping maintain a Proof of Stake network, without the hassle that comes with it.

Individuals can use their crypto tokens to “vote” for the nodes that validate transactions. This increases the node’s overall stake and thus their chance to be selected. Validator nodes, in turn, distribute part of the rewards they get for their work to the “delegators” that voted for them, in proportion to what they contributed.

One of the best features of staking is that you can do it without relinquishing custody of your funds. Whether this is possible will depend on the type of platform you choose to do it on.

Centralized vs. Decentralized

Like many aspects in this market, staking can be done in a centralized or decentralized manner. Most centralized exchanges, like Coinbase or Binance, offer you the ability to deposit your crypto into a staking account and earn rewards. You do not need to do anything else other than click a few buttons, and the exchange takes care of the rest. It’s actually pretty simple, but there’s a tradeoff.

There is a common adage in this industry: Not Your Keys, Not Your Coins. Many believe you do not really own your cryptocurrencies if you do not own the private keys, which are what centralized exchanges hold custody of when you store your crypto in their platforms. Essentially, you depend on a third party on whether your funds are safe or if you can withdraw them and use them.

The alternative is to use a non-custodial wallet, which is a decentralized application that allows you to own the private keys. The most common way to access these wallets is through a browser extension, like Metamask. You can even add hardware, like a Ledger, to store your private keys more securely; a practice known as cold storage. Non-custodial wallets allow you to earn staking rewards while maintaining full ownership over your crypto.

Read our article on Non-Custodial Staking to learn more about how to participate in this process.

Choosing the centralized or decentralized route really depends on what you value more: simplicity or control.

Watch our FishTalk video to learn more about the different types of Proof of Stake validators.

Now let’s go through some key aspects to consider for those seeking the advantages of staking in a decentralized way.

Selecting a Validator

Non-custodial staking allows you to select validators to earn rewards with. However, this decision should not be taken lightly. The most important aspects to consider are how safe they are and what their historical performance looks like.

Some rules of thumb to determine whether a validator is legitimate are if they have a name, not just a public address, or presence online, like a website or social media channels. Performance indicators vary by network, but they’re mostly around how often nodes are selected to validate, the percentage of time they remain in operation, or uptime, and whether they’ve been slashed.

Slashing is a penalty that is given to a validator for misbehaving. The network reduces the validator’s funds as a consequence, including part of the funds that delegators have staking with them; so this is a risk for delegators. The bad behavior that leads to slashing is typically due to significant downtime of their node operation.

In addition, it is best to select a validator that has its own stake similar to yours, since the reward you get is in proportion to what you contribute. In fact, each validator has a point of saturation that is reached when too many delegators are staking with them. When a validator is saturated, their reward rate is lower compared to those that are not saturated, all else being equal. This is a mechanism in the Proof of Stake network to encourage the distribution of delegation across various nodes, and thus limit the power that a single validator may have. At the same time, it is not recommended to choose one with a very small stake, because it may seldom be selected to validate. So, there is a balance you need to consider.

Reward Rates

The rate at which delegators earn rewards for staking is normally on an annual basis. This rate is different for each network and may vary over time, but it usually lies within a range or an average. Several factors come into play, most notably:

- The fees charged by the different validators in the network. Each validator charges a percentage out of the rewards distributed to their delegators.

- The number of network participants; both validators and delegators.

- The network inflation rate, which is tied to how often new tokens are added to the network and is determined by the protocol.

There are various resources available to identify the reward rates of the different Proof of Stake networks. Some validators, including ourselves, have this information available on their website, for the networks they support. We encourage you to explore our website for more information.

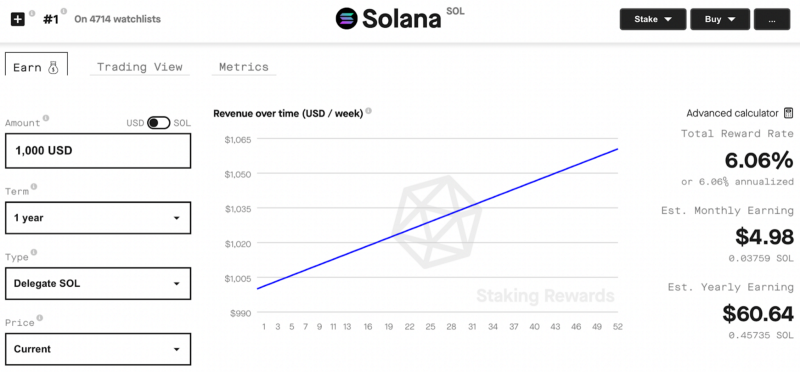

Another great option is Staking Rewards. For each Proof of Stake network, there is a profile page that includes useful information, like the average annual reward rate, as well as a staking calculator. This calculator allows you to simulate how much you would earn, on average, for a particular amount staked within different timeframes, starting with 1 year.

Governance

Staking not only allows you to earn rewards, but also allows you to take part in the governance arena! Most Proof of Stake networks seek decentralization, to the point of allowing its community of “stake”holders to contribute to governance proposals, that can include infrastructure upgrades, signaling proposals for action, and execution proposals to manage community funds.

It is worth noting that not all Proof of Stake networks allow their “stake”holders to participate in on-chain governance. Furthermore, there are various flavors of on-chain governance that range from “one-token-one-vote” systems to delegated voting power. Validator service providers, like stakefish, generally lead the charge in dictating which governance proposals voting directions go and often provide informative rationales on why votes were cast. The larger the stake aggregated to a validator, the larger the governance power and staking rewards affiliated.

Nonetheless, you can also participate in this process by selecting validators with a history of voting decisions that align with your ideals. Validators that are active in governance typically share their voting decisions on their social media channels.

We at stakefish support various Proof of Stake networks with secure and reliable validation nodes. We have a long track record of high uptime, and thus low probability of slashing. Our low fees allow us to offer competitive staking reward rates for our delegators.

In addition, our governance decisions have generally been for the health of the network, in exchange for personal economic interests, or profit. Be sure to follow us on Twitter to monitor our voting decisions.

Visit our website to start staking with us today.

From your friendly neighborhood validator, stakefish.

This article is for informational purposes only and should not be taken as financial advice or as a recommendation to make a specific investment.

About stakefish

stakefish is the leading validator for Proof of Stake blockchains. With support for 20+ networks, our mission is to secure and contribute to this exciting new ecosystem while enabling our users to stake with confidence. Because our nodes and our team are globally distributed, we are able to maintain 24-hour coverage.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish

YouTube: https://www.youtube.com/c/stakefish