Staking 101

If you follow crypto at all, you’ve probably come across the terms “staking” and “Proof of Stake.” If you’re new to crypto or getting back into it after a break, you might not have a strong understanding of what these terms mean.

While the idea has been around for nearly a decade, Proof of Stake, often shortened to “PoS,” has only come to real prominence in the last few years. 2020 has been a particularly eventful year for the Proof of Stake ecosystem, with a slew of mainnet network launches and the high-profile upcoming release of Phase 0 of Ethereum 2.0, in which the network will begin to transition from Proof of Work to Proof of Stake.

Proof of Stake vs. Proof of Work

If you want to understand the current state of crypto, you need to understand Proof of Stake — and to understand Proof of Stake, it helps to understand Proof of Work (PoW).

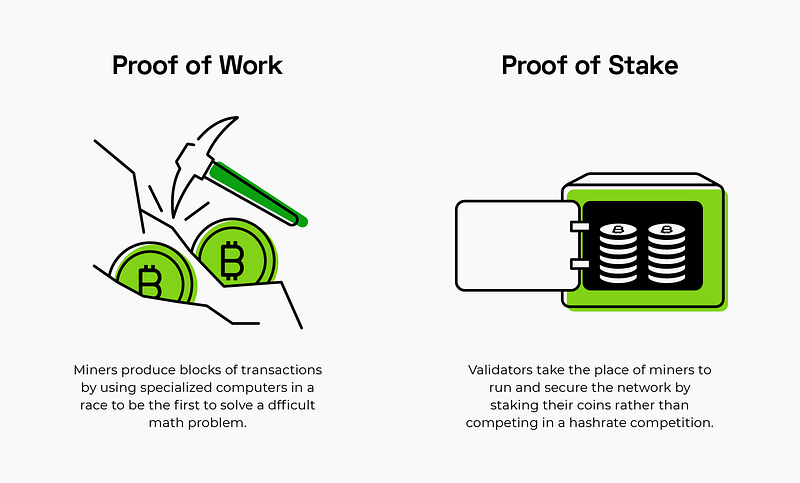

Decentralized networks like blockchains need a way of agreeing on the transaction history of the network. The first blockchains, like Bitcoin, solved this problem using the Proof of Work consensus algorithm. In Proof of Work, “miners” produce blocks of transactions by using specialized computers in a race to be the first to solve a difficult math problem. Because it requires a tremendous amount of computing power, or hashrate, to solve this math problem, it is very expensive to “cheat.” Seizing control of 51% (the threshold required to reliably pull off attacks like double-spending) of the hashrate on the Bitcoin network for just one hour, for example, would cost nearly half a million dollars at the time of writing. Using that hashrate honestly to mine blocks would almost certainly be more profitable than using it to engage in bad behavior.

In a Proof of Stake system, participants called “validators” take the place of miners to run and secure the network by putting up or “staking” their coins, rather than by competing in a hashrate competition. Like PoW miners, these validators propose and verify blocks. They are kept honest by the ever-present possibility that their stake will be deducted from or “slashed” if they make mistakes or engage in malicious behavior, such as proposing two different blocks at the same time. As in Proof of Work systems, gaining control of enough influence to act maliciously in a large network is very costly. In Ethereum 2.0, for example, assuming the current market capitalization of ETH, it would cost a minimum of $12.5B to take control of the 33% of coins required to reliably execute double spends and other attacks.¹

Advantages and trade-offs

Proof of Work has a relatively long history of reliability and security for large blockchain networks. If Proof of Work is so safe and battle-tested, why do we need Proof of Stake?

Scalability

One of the toughest problems blockchain networks face is the problem of maximizing transaction throughput. Wide adoption will be difficult to achieve as long as blockchain networks can only confirm a few hundred transactions per minute. This issue has been urgently highlighted with the exploding popularity of decentralized finance (DeFi), which has seen transaction fees on the Ethereum network hit new all-time highs in recent months.

Proof of Stake paves the way for a scalability improvement called sharding, in which a blockchain’s state is partitioned into individual pieces called shards, each of which contains a fragment of the network’s total state and transaction history. This allows nodes to process transactions for a subset of shards rather than for the entire network, increasing transaction throughput. This approach to scalability is notably incorporated in the NEAR blockchain and is also planned for Ethereum 2.0.

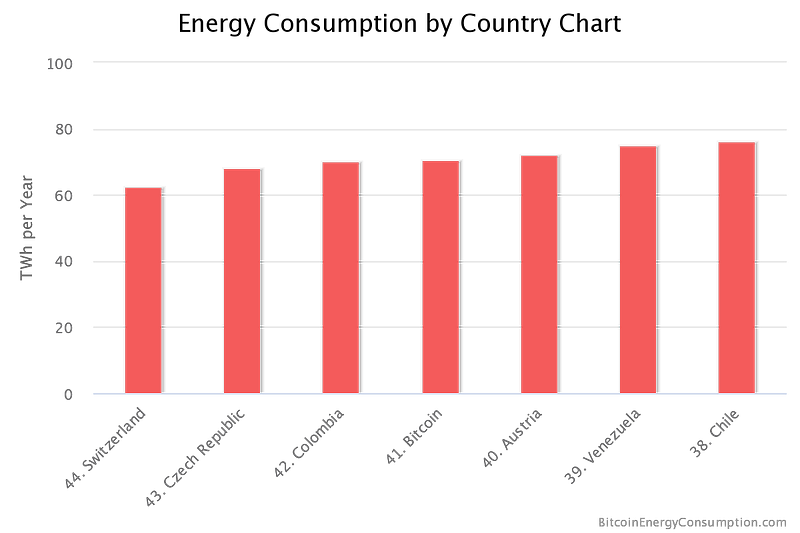

Energy Use

Much has been made in the media about the amount of electricity used to power Proof of Work blockchain networks, particularly Bitcoin. By one estimate, a single Bitcoin transaction can consume as much as 618.18 kWh at the time of writing, enough to power the average US household for almost three weeks. A recent study concludes that Bitcoin’s energy consumption may actually be underestimated. Many Proof of Work advocates contend that the energy costs of running a large Proof of Work network are outweighed by the advantages these decentralized systems provide for their users.

Because computing power is not a major factor, the energy costs of Proof of Stake networks are a tiny fraction of the energy costs of Proof of Work networks. In many Proof of Stake networks, the physical infrastructure needed to run a validator can be as little as a personal laptop or a Raspberry Pi. Mina Protocol (formerly Coda Protocol) plans to release a Proof of Stake network with such a small blockchain that nodes will be able to run on a smartphone. These devices use very little power compared to the graphics cards and dedicated mining chips required for profitable Proof of Work mining. Additionally, thanks to delegation, many stakers (though for decentralization’s sake, we hope not too many) will not run nodes at all, further limiting power consumption.

Decentralization

Decentralization is the degree to which power or control is widely distributed across a network. One of the primary goals of blockchain technology is to enable such decentralized networks, in which no single entity has full control.

The drastically reduced costs of running a validator in most Proof of Stake blockchains may make it easier to achieve decentralization than in Proof of Work networks. It stands to reason that the easier it is to run a validator independently, the more independent validators there will be.

Delegation

Many Proof of Stake networks incorporate a delegation function, in which coin holders can delegate their coins to a third-party validator to eliminate the need to run their own infrastructure, usually for a percentage of the rewards. This allows holders with smaller amounts to reliably receive rewards on a regular basis. This inclusivity comes with a caveat: Too many holders delegating to a third party rather than running their own validator nodes can threaten the network’s decentralization.

Trade-offs

Critics of Proof of Stake highlight the potential risks involved in migrating from Proof of Work — which has proved itself reliable over a span of nearly ten years in Bitcoin and other projects — to the relatively young technology of Proof of Stake. Successful Proof of Stake networks like Cosmos, Polkadot, and Tezos provide some pushback against this contention, though these networks are much smaller than Bitcoin and PoW-based Ethereum 1.0. Ethereum 2.0 will be the most important experiment in Proof of Stake so far, and the results will be critically important for the entire industry.

Further reading on Ethereum 2.0

If you’re interested in how Proof of Stake will work in Ethereum 2.0 in particular, we’ve put together a series of guides to kickstart your investigation of this vast topic. Start here:

Then check out our “Deeper dive” series for a more in-depth exploration:

If you’re an ETH holder who just wants to be ready when Ethereum 2.0 arrives, try this:

- Taking into account the practical difficulty and market moving that would inevitably be involved in purchasing such a large percentage of the total supply, the real cost would probably be considerably higher.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish