Optimistic Rollups: How They Work and Why They Matter

If you’ve used the Ethereum network at all in the past few months — especially if you’ve used it to interact with DeFi protocols or other…

Learn about optimistic rollups, then use our optimistic profile picture generator to show your support!

If you’ve used the Ethereum network at all in the past few months — especially if you’ve used it to interact with DeFi protocols or other smart-contract-based projects — you have firsthand experience with one of the biggest hurdles the network has yet to overcome: prohibitively expensive transaction fees.

In terms of scaling solutions, much of the focus has been on the launch and eventual merging with the original chain of Ethereum 2.0, which will use sharding to increase Ethereum’s transaction throughput. More recently, buzz has also been building around EVM-compatible blockchains like Polygon (previously Matic Network), xDAI, Harmony, and a number of others. Competing smart contract platforms like Solana and NEAR also provide low-fee alternatives.

One of the most anticipated scaling solutions with some of the best potential for easing congestion is set to be released this month: optimistic rollups from Ethereum Optimism.

What are optimistic rollups?

Optimistic rollups are a layer 2 scaling solution. A layer 2 solution is a network that takes some of the processing work off the main (or layer 1) Ethereum chain with the aim of improving performance. The goal of optimistic rollups is to decrease latency — the amount of time it takes to confirm a transaction, currently limited by Ethereum’s block time of about 13 seconds — and increase transaction throughput — the number of transactions that can be processed each second — thereby reducing gas fees.

Contrasting with sidechain solutions, optimistic rollups still use the primary Ethereum chain for consensus and security.

How do optimistic rollups work?

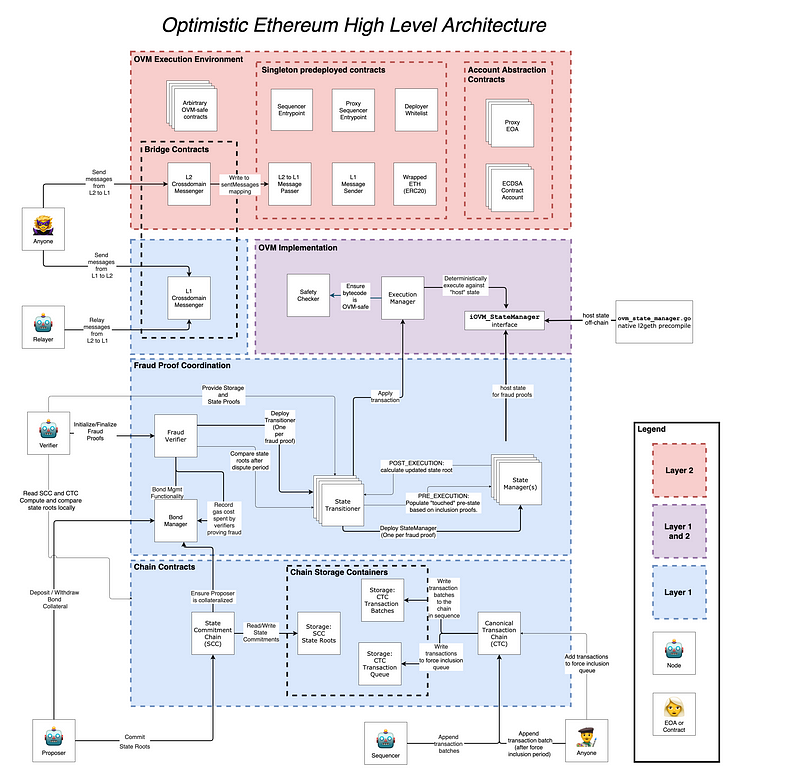

From a high-level vantage point, the main components that make the system work are the rollups themselves, Sequencers, adjudicators (or fraud proving contracts), and the Optimistic Virtual Machine.

Rollups are regular smart contracts on the Ethereum mainnet that serve as the relay between the main chain and layer 2, where the computations take place. Rollups receive the transaction data, send it to layer 2, and receive the results of the layer 2 computations.

Transactions sent to the rollup contracts are received on layer 2 by Sequencers, which respond with a signed receipt pledging to accurately execute and order the received transaction. While Sequencers are rewarded for playing by the rules and executing transactions as expected, they are also required to stake funds that will be slashed if they act maliciously. If someone suspects fraud, they can prove it by alerting an adjudicator contract on the Ethereum mainnet, which is able to verify the validity (or invalidity) of the results produced by the Sequencer using the Optimistic Virtual Machine. The offending sequencer will be slashed, and some of the slashed funds will be rewarded to the whistleblower.

For a deeper and more detailed understanding of how optimistic rollups work, try the official documentation.

What can optimistic rollups achieve?

Optimistic rollups are expected to have roughly 100x more throughout than the layer 1 Ethereum chain. If this scaling solution is widely adopted, it should go a long way toward relieving some of the congestion the Ethereum network is currently experiencing.

A number of major players in the DeFi space have demonstrated an interest in the technology, and Optimism’s incentivized testnet was co-sponsored by Synthetix, Uniswap, and ChainLink.

Resources

- https://medium.com/ethereum-optimism/optimism-cd9bea61a3ee

- https://community.optimism.io/docs/protocol/protocol.html

- https://medium.com/plasma-group/ethereum-smart-contracts-in-l2-optimistic-rollup-2c1cef2ec537

- https://twitter.com/0xRafi/status/1366864714664402947

- https://research.paradigm.xyz/optimism

- https://research.paradigm.xyz/rollups

About stakefish

stakefish is the leading validator for Proof of Stake blockchains. With support for 10+ networks, our mission is to secure and contribute to this exciting new ecosystem while enabling our users to stake with confidence. Because our nodes and our team are globally distributed, we are able to maintain 24-hour coverage.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish