Non-Custodial Staking

Staking allows you to receive rewards, just by owning crypto. Anyone can help maintain the security of a Proof of Stake network and…

Staking allows you to receive rewards, just by owning crypto. Anyone can help maintain the security of a Proof of Stake network and generate the rewards.

Read our article What is Staking Crypto? to learn more about this concept.

One of the best features of staking crypto is that you can do it without relinquishing custody of your funds, which is possible through non-custodial staking.

Non-Custodial Wallets

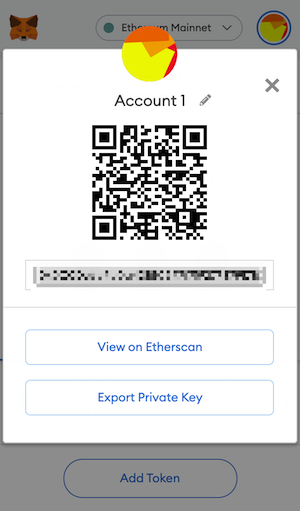

A non-custodial wallet is a decentralized application that allows you to store your crypto while you own the private keys. This is different from keeping your crypto in a centralized exchange, like Coinbase or Binance, where a 3rd party holds custody of your private keys. Remember: Not Your Keys, Not Your Coins.

Another benefit is that your account remains quasi-anonymous. Most centralized exchanges require you to provide your personal information, or “Know Your Customer” (KYC) data, to open an account. Non-custodial wallets don’t require this thanks to their decentralized nature.

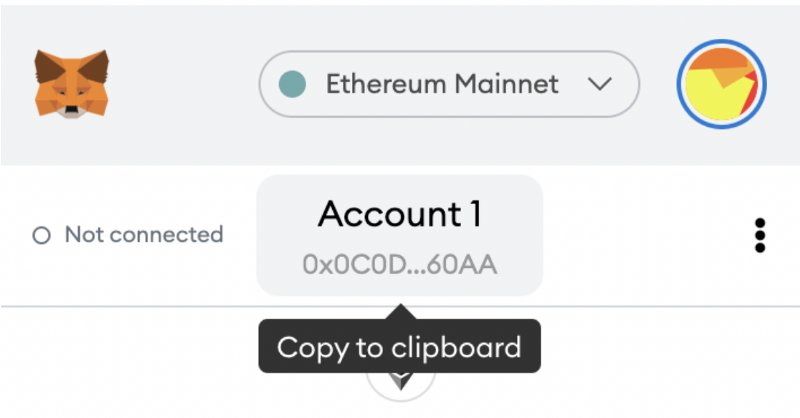

The most common way to access these wallets is through a browser extension, like Metamask. When you download the wallet to your browser, you are given a seed phrase, which is a series of random words that gives you access to the wallet from any computer. Think of the seed phrase as being like the master password. Therefore, it’s recommended that you store your seed phrase safely, ideally written down offline, and to NEVER share it with anyone.

Unfortunately, not all cryptocurrencies can be added to one particular non-custodial wallet, at least not yet. For instance, Metamask allows you to store crypto from a variety of networks, including Ethereum and Polygon. However, you’ll need a separate wallet for Cosmos, such as Keplr Wallet.

Another drawback is that most non-custodial wallets do not allow you to purchase crypto. Metamask recently enabled the purchase of crypto through their mobile app using Apple Pay, but this is only available in certain countries. Most likely, you will need to transfer funds from a centralized exchange.

Transferring Funds

Non-custodial wallets assign a unique public address, which is represented by an alphanumeric code, to each of their users. If you bought your crypto in a centralized exchange, you can simply send your funds to your non-custodial wallet by entering the public address at withdrawal.

There are two things that are extremely important to be aware of when withdrawing your crypto:

- Input the exact public address. If you input the wrong address, you may lose your funds, so make sure to double check this. It’s also recommended to use the QR code instead of writing down the address. You can use your computer’s camera or your mobile phone’s camera to activate the code.

- Be sure to choose the right network. Typically, the platform you are sending your funds from will let you know if the address does not correspond to the network, but it does not hurt to double check this as well.

Cold Storage

Other than whether they are in a centralized or decentralized environment, cryptocurrency wallets can be hot or cold.

Hot wallets are always connected to the internet and to the blockchain. This means that the private keys are stored on an internet-connected application, which may expose them to hacks or thefts. All custodial wallets, or those in centralized exchanges, are hot. This is not the case for non-custodial wallets.

Cold wallets, on the other hand, store the private keys offline, protecting them from hacks. Even if you make a transaction online, your cold wallet will confirm it in an offline environment. Cold storage is achieved through hardware devices similar to USB drives, such as a Ledger. These devices also offer digital platforms that allow you to see and manage your funds. You can even connect your hardware to popular non-custodial wallets, like Metamask. You will need to confirm every transaction with your device, but it is worth doing so to secure your crypto.

Some people consider the hardware devices needed for cold storage expensive (most cost more than $100 USD) and may prefer a hot wallet instead. Thankfully, non-custodial staking is possible with both options.

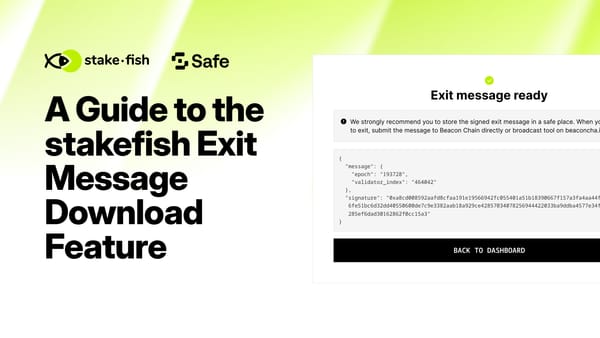

Non-Custodial Staking

Non-custodial staking allows you to earn rewards while maintaining control of your funds. You can choose to participate with or without your Ledger device (i.e. cold wallet), but you do require a non-custodial wallet.

Each network has a particular process to stake their native token. Some aspects vary, but in most cases you’ll need to select a validator node.

Refer to our What is Staking Crypto? article to review the key considerations when selecting a validator.

Among the aspects that vary on each network, the most important are the following:

- Reward rate: This is probably what you’re most interested in. It’s basically the rate at which you earn rewards for staking, on an annual basis. Refer again to our What is Staking Crypto? article to learn about what factors into this value.

- Access: In most cases, you will be able to connect your favorite non-custodial wallet to the network’s digital platform and follow the steps to access the staking process. However, in some cases you can do so directly on your cold storage wallet. For instance, Ledger allows you to stake Cosmos directly on their downloadable application, Ledger Live. In any case, you will still need to select a validator.

- Minimum amount to stake: This amount can be more than you are willing to pledge to a validator. Be sure to research this before purchasing a crypto token you want to stake.

- Unbond period: You do not have to relinquish custody of your funds through non-custodial staking, but you will not have access to them while you are earning rewards. You can choose when to “unlock” your funds from staking, but in many cases, there is a time you need to wait before you regain access to your funds and you will not earn rewards during this time. This is called the unbond period and it may vary from 2 days to almost a month. Be sure to also identify this before committing your funds to staking and to plan accordingly.

Liquidity Staking

Liquidity staking is a version of non-custodial staking that allows you to circumvent some of the limitations discussed before.

The way it works is, for the crypto you stake, you are given an equivalent amount in a synthetic token pegged to its price. You are able to trade the synthetic token in the open market, without needing to “unlock” your funds from staking and wait until the unbond period ends. When you do decide to release your crypto from staking, you are returned an amount in proportion to the synthetic token you still hold. You don’t have to worry about the minimum amount to stake and you can also access the service with your hardware, or cold wallet. Liquidity staking is not available for all Proof of Stake networks, but it is for some of the most popular, like Ethereum, Solana and Polygon.

However, there are some caveats to consider. There is no guarantee that the synthetic token will keep its peg and you don’t get to select the validators for staking. The option is non-custodial, but you have less control over the security of your funds. So, be sure to do your research on each platform where you plan to participate in.

Lido is a well-known liquidity staking platform. We are genesis supporters of Lido and will continue to do so into the far future.

Read our article Lido & liquid staking to learn more about this option.

We at stakefish support various Proof of Stake networks with secure and reliable validation nodes. We have a long track record of high uptime, and thus low probability of slashing. Our low fees allow us to offer competitive staking reward rates for our delegators.

Non-custodial staking has its benefits, but there is a bit of legwork to be able to participate in the process. We recognize this and offer step-by-step guides, along with key information, for every network we support. All you need to do is set up your non-custodial wallet and gain access to funds, and we’ll show you how to do the rest.

Watch our video on How to stake Solana (SOL) with Ledger and Solflare Wallet to see an example.

We continuously add new blockchain networks to the ones we support, but rest assured these are quality projects. In fact, we spend a great deal of time researching each network we decide to include. Be sure to follow us on Twitter to monitor the latest networks we’ve added.

Visit our website to learn more and start staking with us today.

From your friendly neighborhood validator, stakefish.

This article is for informational purposes only and should not be taken as financial advice or as a recommendation to make a specific investment.

About stakefish

stakefish is the leading validator for Proof of Stake blockchains. With support for 20+ networks, our mission is to secure and contribute to this exciting new ecosystem while enabling our users to stake with confidence. Because our nodes and our team are globally distributed, we are able to maintain 24-hour coverage.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish

YouTube: https://www.youtube.com/c/stakefish