Ethereum Staking Services — Alex Wykoff | ETHDenver 2022

Increasing Access While Keeping Stake Decentralized

Increasing Access While Keeping Stake Decentralized

Watch the full presentation from stakefish Head of Product Alex Wykoff at ETHDenver 2022 on Youtube.

Refresher on Ethereum staking:

1 Validator. 32 Ethereum.

Staked Ethereum and Rewards are locked until withdrawals are implemented after The Merge.

Validators go through a series of stages in their life cycle.

- Deposited: A deposit contract has been filled with 32 ETH

- Pending: A Validator is utilizing the contract and is being processed by the Beaconchain

- Active: The same validator is now participating in proposing valid blocks.

- Exited: The validator has ceased operations.

Why should someone stake?

🦾 It helps secure the network.

- More Validators in operation means lower chances of collusion and manipulation.

🪨 The demand is stable.

- Ethereum will need validators for as long as it is in operation and The Merge occurs.

Ξ It’s rewarding.

- Validators earn rewards for proposing valid blocks. Validators can also earn rewards for attestations of blocks that are proposed by others. Slashing other validators also earns rewards.

Why shouldn’t someone stake?

🔐 Ether is locked.

- Withdrawals will not occur for quite some time.

🏡 It’s expensive.

- Operating a validator requires 32 ETH.

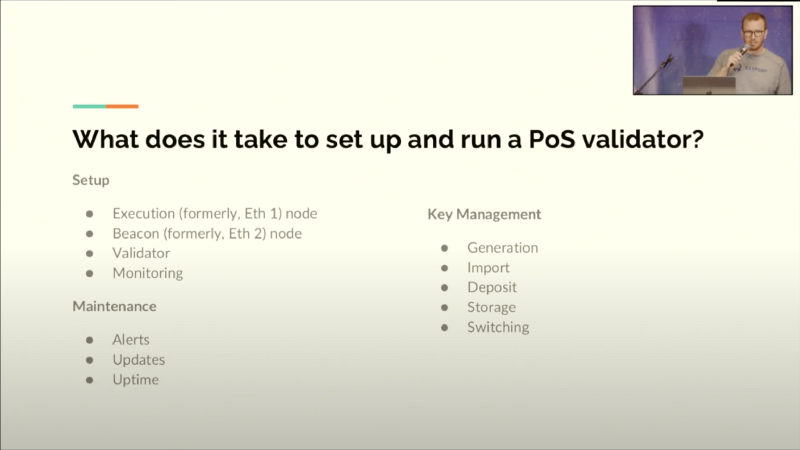

🚀 👩⚕️ It can be complex.

- Required knowledge for validator operation includes DevOps & SecOps as well as specialized knowledge of how Ethereum works.

Why does decentralization matter?

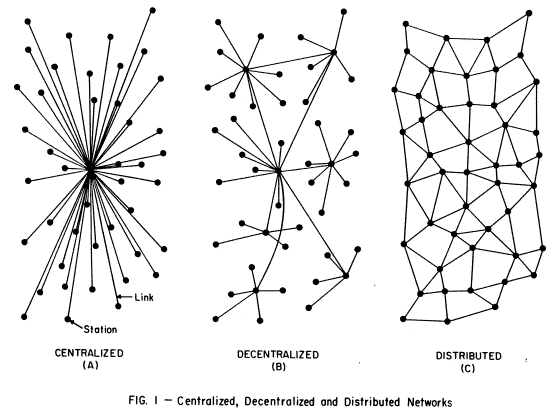

When you have a centralized system you have a single point of failure or manipulation.

When you have a decentralized system you have more robustness in your network. It’s much harder to take down a network that is spread over countries and geographies.

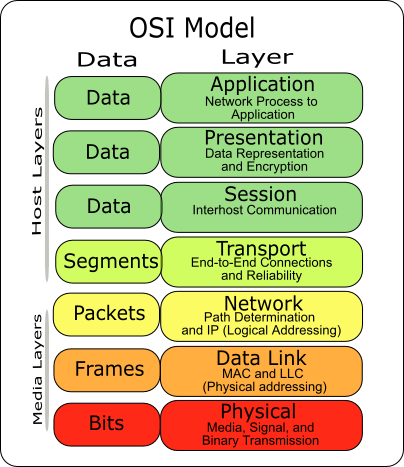

How does decentralization manifest itself?

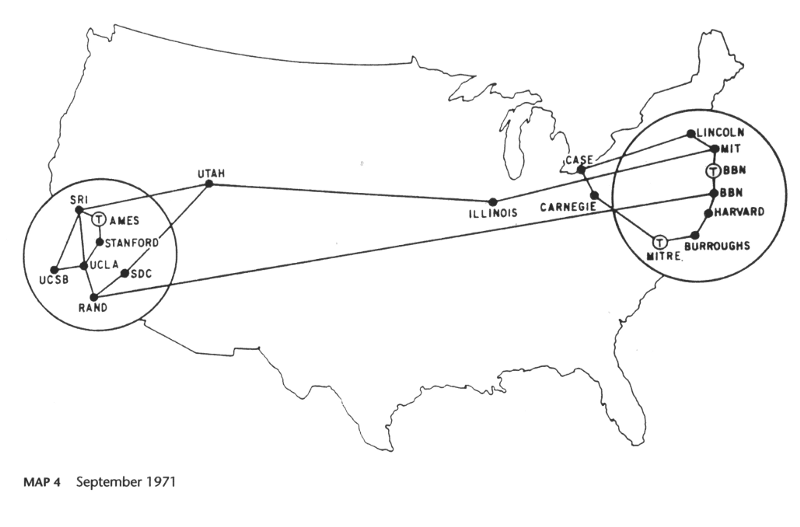

This is both a biological example and a practical example. We have many different layers in our stack that we can think about. We can have hardware decentralization — many types of hardware that are running the validators. We can have transport layers.

For example, In the fall of this year, Bitcoin added the invisible internet project as one of its routing options into its core protocol.

Lastly, we have all kinds of application and presentation layers — which are wonderful apps that you all enjoy.

Staking access is a form of decentralization

You want to have more people participating in staking. Not just the people that can afford it from the start.

When the Beaconchain first launched (December 1, 2020), the price of ETH was ~$598.

- 🚙 Validator deposit value: $19,136

A year later, the Ethereum Price was ~$4,511.

- 🏡 Validator deposit value: $144,352.

As of February 17th, 2022, the ETH price is $3,027.

- 🏡 Validator deposit value is $96,864

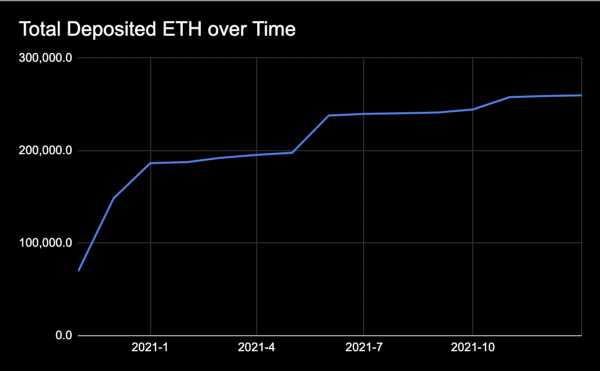

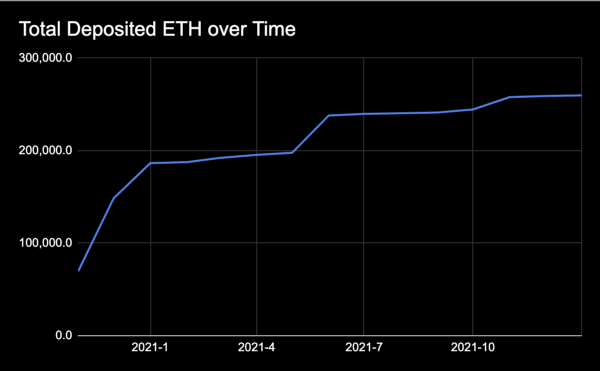

Observing a constraint — stakefish’s deposit contract

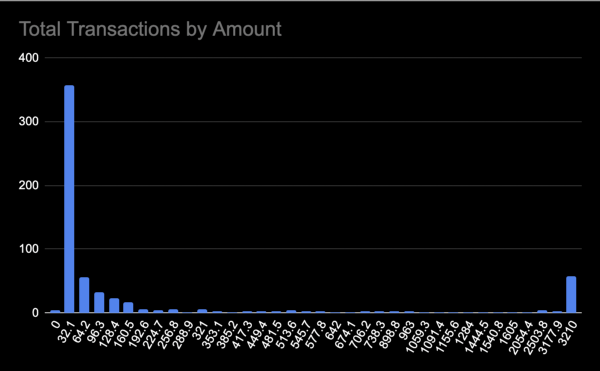

In the past, you can deposit 32 ETH with stakefish and we run a validator on your behalf. Tracking the action on the smart contract that manages it, you can see that the total deposited ETH tapered over time.

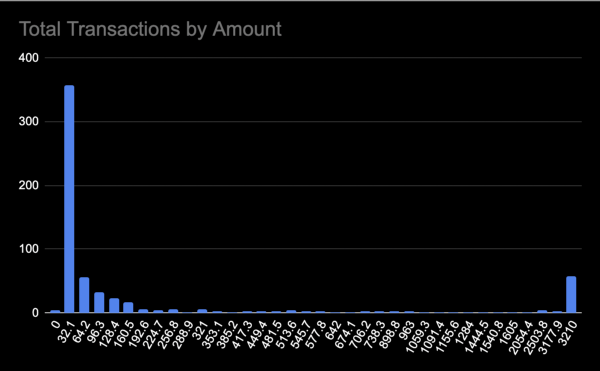

If you look at transactions by amount because we allow you to spin up multiple validators in one call, the vast majority of them were at the 32 ETH level.

What does this tell us?

It tells us that there’s a natural limit to the number of people that have 32 ETH available at any one point in time — and it tells us that there are a lot of people with 32 ETH or less.

Staking options for less than 32 ETH

Liquid / Tokenized Staking

Non-Tokenized (Vanilla) Staking

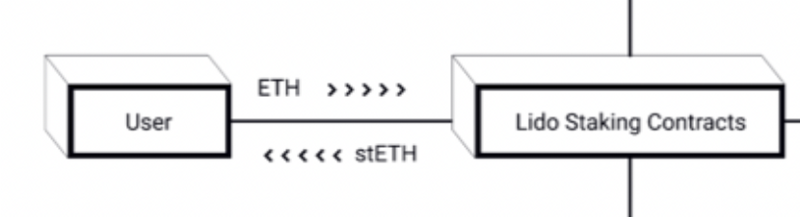

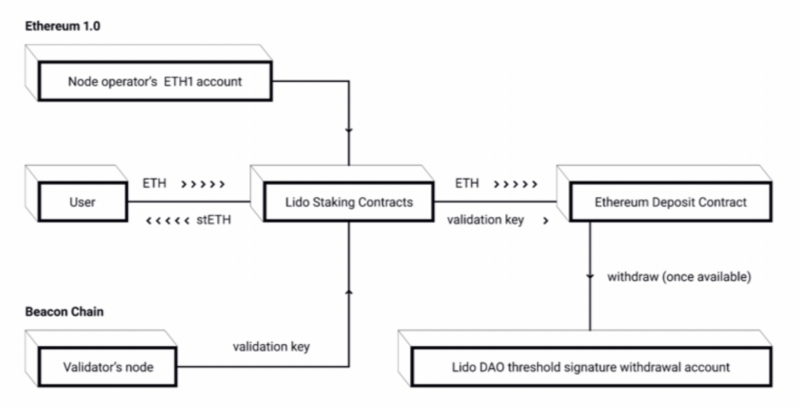

Staking options for less than 32 ETH — Lido

Exchange your ETH for stETH.

Exchange stETH back to ETH via 3rd-party liquidity pools like Curve, Balancer, etc.

What Lido does under the hood is much more complex. But, from the participant’s perspective, all that was really done is the exchange.

stETH rebases on a daily 24 hours basis to reflect ETH staking rewards.

Just holding stETH means you benefit.

stETH can be used in many DeFi apps.

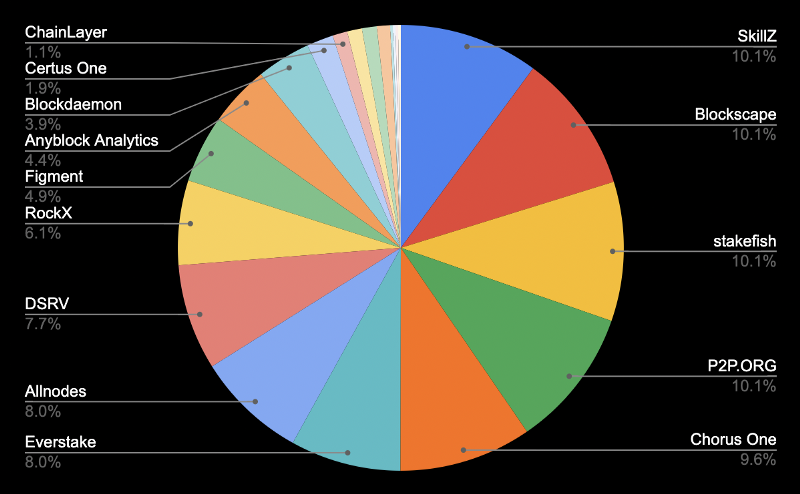

The initial set of node operators are selected by Lido.

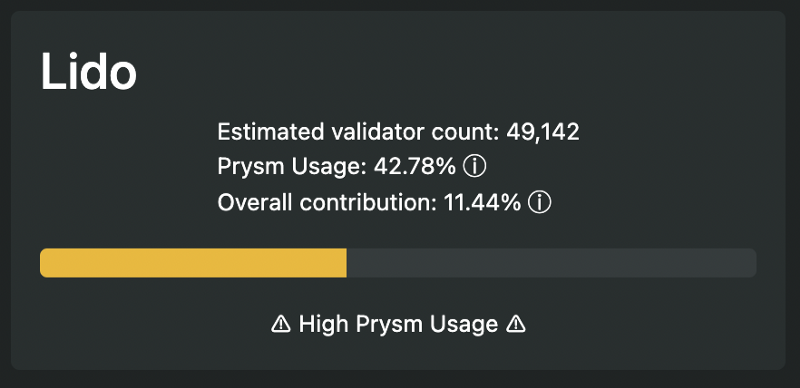

Currently, there are 22 operators. Full disclosure, stakefish is an operator for Lido.

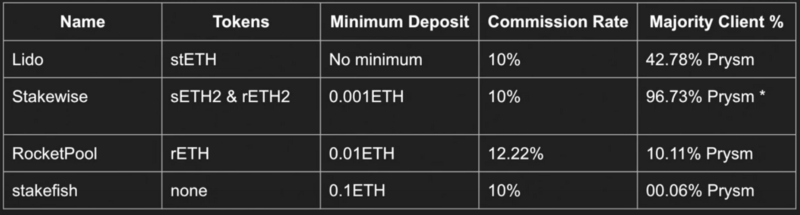

If we look at client distribution, we can see that they have a little bit less than 50% Prysm usage.

Again, if we’re talking about decentralization, knowing about the amount of operators and the clients they use is important.

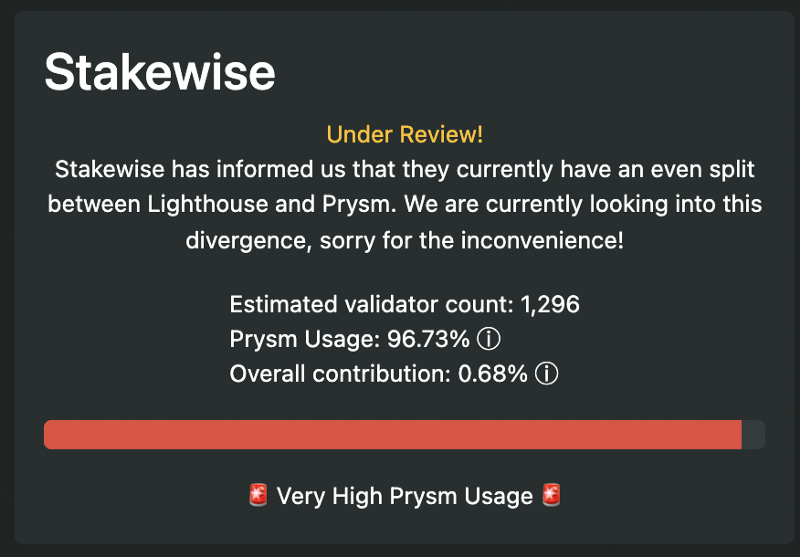

Staking options for less than 32 ETH — Stakewise

Exchange ETH for sETH2

Receive rewards in rETH2 — that’s compelling because you’re able to have one thing that is your collateral and another thing that is your reward on the other side.

This separates concerns of how to categorize earnings and could mitigate some risk of impermanent loss.

Don’t take this as gospel because it’s under review, but it does seem like their Prysm usage is above average. And their node operators are Stakewise employees.

To compare that with Lido, they have multiple different operators under the cover where with Stakewise they have one set of operators, which is themselves.

Staking options for less than 32 ETH — RocketPool

Exchange ETH as low as 0.01ETH for rETH

RockPool groups fractional ETH with operator collateralized nodes.

Rewards are given to participants when rETH is redeemed for ETH instead of rebasing in the way that Lido does or separating rewards in the way that Stakewise does.

Node operators are permissionless. They use a specialized internal token, RPL.

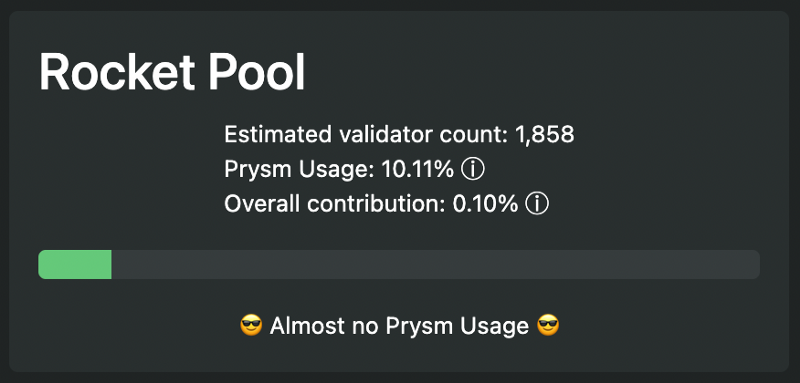

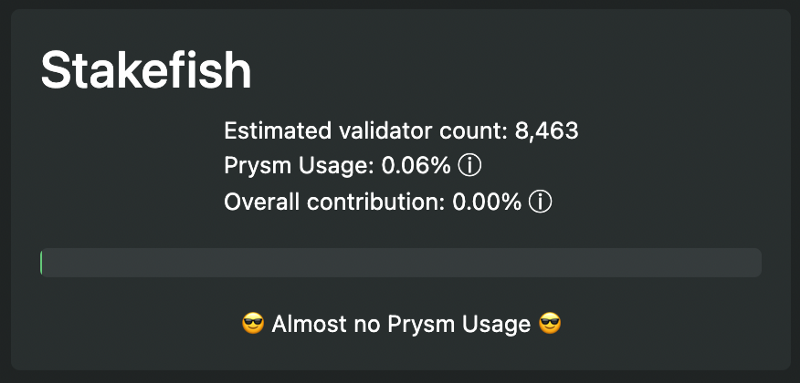

Each node operator utilizes a RPL/ETH ratio, 16 ETH+ at least 10% of ETH value in RPL as insurance. Prysm usage is quite low.

Liquid/Tokenized Staking

To summarize:

Assumptions of token value & liquidity because in every one of those cases you’re making some kind of an exchange and then you’re thinking to do some kind of a DeFi play afterwards.

What’s going to happen inside of those scenarios?

You’re required to interact with liquidity pools to exit pre-Mergee pre-Withdrawals and DeFi options require more active management.

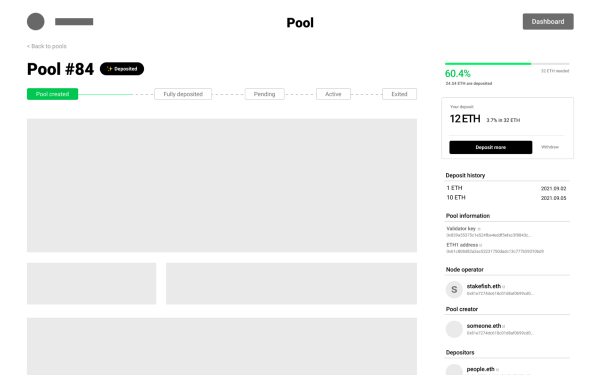

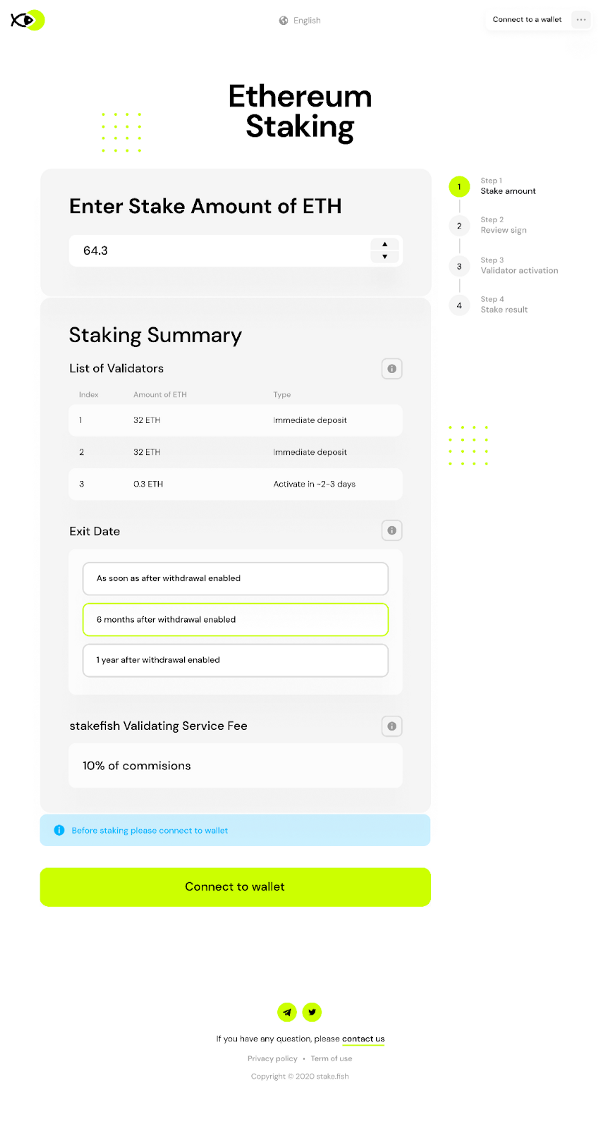

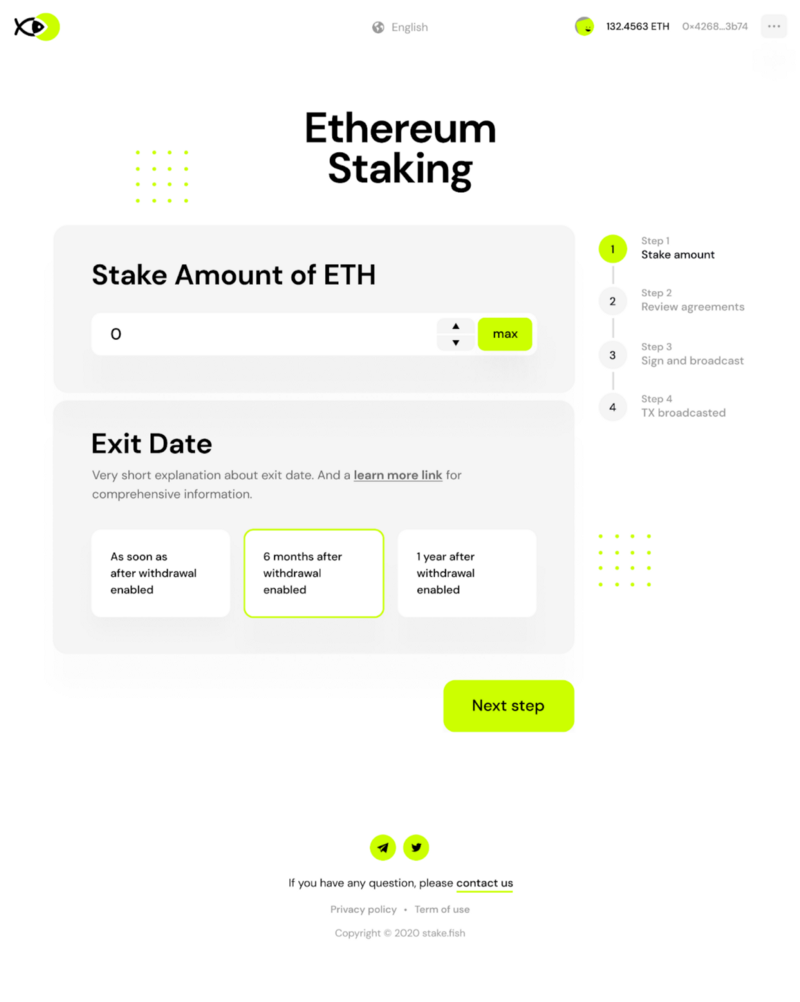

Staking options for less than 32 ETH — stakefish

Stake with as little as 0.1 ETH

Ethereum is deposited into a contract. When the stakefish deposit contract reaches 32ETH, a validator instance is spun up. From there, that’s it. You’re staking.

When withdrawals are enabled, the original stake as well as % of stake in validator rewards minus commission is returned.

Node operators are stakefish employees.

Gas might be more expensive than other options.

Participants will have to wait quite a while before they can withdraw and receive rewards. We have to wait post-merge, post withdrawals.

As you can see, Prysm usage is quite low.

So, as you can see, who is operating the actual validators, what are you actually doing with your staked ETH, and what kind of clients are running?

Comparison at-a-glance.

A look under the hood: Why did stakefish choose a different method?

Review:

We saw that the amount of deposited ETH was tapering over time and the overwhelming majority of what was being deposited was at the lowest amount you could do — which was 32 ETH.

Observation:

Deposits of 32ETH appear to be tapering.

How do we encourage more participation?

Solution:

Lower the barrier of entry and allow people with less than 32ETH to stake.

We did an exploration. Initially, we brought on a technical advisor and they reached out to some folks in the Ethereum Foundation and elsewhere and they suggested that this be a community project and a standard that should result in an EIP.

Exploration:

What business models might make sense? How can we make it incentivized for all the users, operators, etc.

- Upfront fees vs commission

- Operating fees in fiat

- Etc.

What complications might arise?

- How to select tokens?

- How can we make this as simple as possible?

- The market has converged on commissions instead of a flat fee.

First Pass

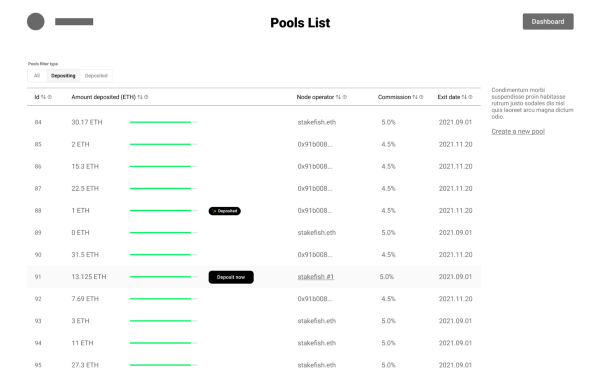

We had this idea that we could do a pool list, similar to RocketPool, where operators could come in and say their commission, this is what we’re doing, and you could choose to participate in it.

Pool Party!

Let’s do this! Right? This is a great idea!

Objection!

We took it back to our advisors and they said, “No, actually you need to think more carefully.”

- Who would be the originator of the relationship?

- What terminology would be used?

- What different kinds of risk is stakefish being exposed to?

Iterations / Refinements / Testing

So, we decided to bring this back to an in-house project rather than a community project.

We refined our UI overtime to make it as easy as we could possibly make it.

Shipped in January!

However, I think we took a wrong turn. What could we have done differently?

When we noticed that risk was going to occur to stakefish individually in an operator-as-coordinator role, that was the right time to bring it back to the community and make a proposal.

This is just thinking in hindsight.

Next Steps

There is an obvious desire from the market for staking from participants with less than 32ETH

Let’s open a discussion where we take these examples, as well as others, and offer a proposal for an enhancement to Ethereum.

Check out: https://github.com/ethereum/distributed-validator-specs

Visit the ETHStaker community: https://ethstaker.cc/

Chat with people!

Summary:

More individuals staking means more activity in the fundamentals of our ecosystem and ultimately, a healthier blockchain.

Watch Alex’s full presentation at ETHDenver 2022 on Youtube. You can find him at @alex_wykoff on Twitter or alexwykoff.com

About stakefish

stakefish is the leading validator for Proof of Stake blockchains. With support for 20+ networks, our mission is to secure and contribute to this exciting new ecosystem while enabling our users to stake with confidence. Because our nodes and our team are globally distributed, we are able to maintain 24-hour coverage.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish