Chun Wang Interview — Staking Rewards

Read the full Staking Rewards interview with stakefish CEO Chun Wang covering underrated projects, the future of DeFi, PoS vs PoW, and…

Watch the full, unedited interview with stakefish CEO Chun Wang and Staking Rewards on Youtube.

Original interview dialogue edited for length and clarity.

What was your first crypto investment outside BTC and ETH?

Namecoin. It was the first blockchain after BTC. Normally I try to avoid using the word “investment” because I buy coins, I sell coins, I hold coins, and use them to pay my phone bill.

What do you think is the most underrated project?

Maybe stakefish :)

It started in 2018 out of nothing but a domain name. The .fish was introduced in 2014. My colleague’s name was bitfish so I’d been watching the bit.fish domain name for years. When it became available, I bought it.

When I bought this domain name I asked, “what are we going to do with it?” I didn’t get any positive feedback, so I decided to do it myself.

I started stakefish in Thailand, originally organized an event in Bangkok, and then it grew up in Korea because we happened to have a few colleagues join us in Korea.

But we always have diversity and decentralization deep in our culture. Our team members come from all different backgrounds.

When we started, we never thought we’d make money out of this. We even thought making money was something disgraceful. But once Ethereum becomes PoS it’s very likely stakefish will become worth more than F2Pool.

So, I do think stakefish is something seriously underrated.

Who in the crypto industry do you respect most?

Satoshi, himself.

14 years ago he was someone sitting in front of a computer screen thinking about Bitcoin, cryptocurrency, and blockchain when almost nobody else ever was thinking about anything similar to this.

And to think about someone later, with billions of dollars of wealth and never moved it — it’s because of this that Bitcoin is Bitcoin.

What I mean is, if we know Satoshi has an identity — like he’s from the US, then people from China and Russia maybe refuse to accept it. Even if Satoshi is Chinese then maybe people from other countries decide the same thing for similar reasons.

Satoshi’s anonymity contributes a lot to Bitcoin’s value.

Second, Vitalik.

A lot of altcoins are like start-up companies. A company by nature is supposed to make a profit — but Ethereum is something different. It’s between Bitcoin and an altcoin.

You’ve never heard from Vitalik how much money he wants to make, how much profit he wants to make from Ethereum. We only hear about what’s the plan with Ethereum and how we can bring blockchain technology to the next level.

For that reason, I must say I respect Vitalek the most, only after Satoshi himself.

How much of your portfolio is staked?

30%.

What is an activity you do to relax from the wild crypto markets?

I’m constantly looking for new countries to check-in to. I use the term “check-in” because it’s different from a typical tourist. “Be there, done this,” and that’s it. I count how many countries I’ve done this in.

I’ve been living a nomadic lifestyle for a few years.

2007 was the craziest year, despite having a full-time job. I only used the weekends to travel. That year I traveled 75,900km on railways — only using weekends. That translates to like two months only inside train cars. The other 10 months were spent sleeping and in the office.

I finished checking in to all the Chinese provinces in 2013 using trains and then transferred to being a frequent flyer. Despite the pandemic, I managed to visit 27 countries in the past 12 months — from Svalbard to the South Pole.

Which country do you enjoy the most?

I’m currently in Malta but I’m very interested in Svalbard. It’s neutral by treaty, everyone can disregard their nationality, and will be treated similarly — at least by rule.

How did you get into crypto? What inspired you to work full-time in crypto and start F2Pool?

I never thought about going full-time into crypto in the first few years.

In the beginning, I was voluntarily contributing my computing power to a project called SETI@Home, aiming to find alien intelligence from radio telescope signals.

One day I read about Bitcoin and was fascinated by the idea so I immediately switched my CPU power from SETI@Home to Bitcoin mining.

The first night I didn’t mine a single Bitcoin. So, I went to the local market and bought some GPUs.

Since then I’ve never stopped working on crypto.

The first year I estimated that Bitcoin will survive two months, enough to pay back my graphical card — which is why I started on Bitcoin almost immediately.

You know, in the end, Bitcoin survived more than 2 months and after 10 years it’s still going strong.

I didn’t know much about economic finance in 2011. Bitcoin was like an eye-opener and it opened a whole new world to me.

I’ve learned a lot over the past decade and am still learning.

On starting F2Pool…

In the first two years, I personally mined 7,700 Bitcoins.

Because of the transition to ASIC I could not use GPU to mine Bitcoin anymore in 2013.

I rented 4 residential apartments for Bitcoin mining. I had a hash rate of about 20–30 giga hash per second. That’s maybe 0.4%, at the maximum, of the total network hash rate.

In late 2012 there had been a few ASIC projects and I ordered a few ASIC units. They arrived March 18, 2011 and that changed my career entirely that day.

The first ASIC unit was as big as a normal computer and had a hash rate of like 60 gig hash per second — that replaced my entire operation and more while consuming only a little amount of electricity. I had no reason to keep the operation running.

Shortly after, I started a mining pool, which is a service where other miners can direct their hash rate to us. We operate a service.

In almost 10 years of F2Pool’s operation history we have mined more than 1 million Bitcoin — that’s like more than 5% all Bitcoin mined is mined from our pool.

Did you sell the 7,700 Bitcoin you mined by yourself?

I sold all the Bitcoin from 2011 and 2012 in January 2013 and paid back my initial loan. I borrowed some money from my parents to build the first GPU configuration. I think the price I sold at was like $11.

You know, with a mining pool we have a small percentage kicked back to ourselves, and we can keep making Bitcoin. That’s the best thing you can do, actually.

What is your take on the future of consensus algorithms?

We were at the center of the stage in the Bitcoin committee in 2015 and 2016 for scaling. From that experience, I would say Bitcoin will remain PoW. There’s almost zero chance that Bitcoin would make such a big transfer from PoW.

But it seems like many other cryptocurrencies will probably be PoS or at some time transfer into PoS. I’ve heard that even the Dogecoin community has planned to transfer to PoS.

There has been little innovation going on in the PoW world. People argue about the energy usage of Bitcoin mining — it’s somewhat valid but on the other hand I personally do not worry about the energy usage that much because there’s an infinite amount of energy in the universe.

I do believe the universe is infinite. So if that’s the case, the total amount of energy usable is probably infinite. It’s all about how you are going to use this energy.

You burn coal. You burn oil. That’s one way to use energy. But there are a lot of other risks to finding energy.

Bitcoin will probably have a good reason for us to improve our energy industry. There’s an opportunity for the energy industry to evolve. Bitcoin will give a lot of new scenarios that traditional energy cannot give us.

I have some ideas of wind energy in the middle of the ocean — maybe the Pacific. You cannot transmit this energy anywhere — for residential or for industrial use to land.

Imagine that if you set up Bitcoin mining facilities in the middle of the Pacific Ocean using windmills and turbines to generate energy and use the energy right in the middle of the ocean. It’s kind of a virtual load balancer. You mine one Bitcoin in the middle of the Pacific and someone else will mine one less Bitcoin elsewhere. It’s an energy load balancer without the physical infrastructure.

Something like this. Without Bitcoin, we would never imagine that it could be possible.

What do you think of the recent mining ban in China?

I haven’t been in China for a few years. I’ve written a few tweets regarding this. F2Pool has been working on decentralizing itself for a few years. I personally moved to Thailand in 2015, then Korea, and am now living a full decentralized and region-neutral lifestyle based in no countries.

I think, generally, the China ban is probably good news. Maybe not in the short term but in the long term it’s definitely good news.

Bitcoin is about freedom. By operating a mining operation you basically do it to secure the Bitcoin network. The security of Bitcoin must be controlled by free-minded and decentralized people. That’s probably not something China shares with us.

I think Bitcoin is heading towards a more healthy ecosystem. It has become more decentralized and more free compared to a couple of years ago.

How do you see Bitcoin compared to proof of stake? Is it more free and decentralized?

Most of PoS implementation by design is a lot more centralized compared to PoW. On the other hand, PoS doesn’t involve a lot of physical equipment. That’s probably something beneficial because when you invest millions or billions of dollars into mining machines you are bound to the place you are mining. It may be more difficult to shut down an Ethereum validator than shutting down a Bitcoin miner or mining farm located in a horrible state.

That’s why I spend time investigating if it’s possible to mine Bitcoin in neutral places such as Svalbard, Antarctica, or the middle of the Pacific Ocean. If that happens it will probably make Bitcoin more decentralized and more free.

In the meantime, I think Ethereum is something different compared to other PoS blockchains.

The Ethereum PoS design could make this PoS maxim mechanism more decentralized compared to other PoS designs.

What do you think is the next big trend in crypto?

I don’t think much about crypto these days. I am still working full-time on stakefish and spending a lot of time on F2Pool. As I mentioned as an investor, I sometimes look into the energy industry. But, I think my hands are full.

I also spend some time looking into how to make life multi-planetary and, more importantly, how to make Bitcoin and cryptocurrency multi-planetary.

I think in the next couple of decades we have a good chance to become multi-planetary. We’ll probably see humans landing on Mars in the next 20 years — but what currency will Mars use, will Martians use?

I think if we can make something like cryptocurrency, or say Bitcoin, to be the currency of Mars that’s something I would personally like to see. But, sadly, Bitcoin is not yet ready for such a use case because Bitcoin has a block span of 10 minutes and the signal one-way from Earth to Mars is something like 5 minutes to 20 minutes. Round-trip is double that. So, we cannot use Bitcoin without modification to use it effectively in a multi-planetary civilization.

I think it’s time to invest some effort on how to make a blockchain, how to make a cryptocurrency, designed for a multi-planetary civilization.

Not just cryptocurrency, but everything.

Let’s say you have a mobile phone, an iPhone. I think in the first couple decades, even centuries, it will probably be for some time that we can not manufacture the iPhone or high-end electronics on Mars. It will take Martian people 26 months to get the new generation of an iPhone.

I think, in the future, the biggest festival will probably not be the new year but the day every 26 months when new spacecraft arrive on Mars.

Then, you wait for 26 months to get the new generation iPhone and find out that there are no Apple servers on Mars. You cannot even activate your iPhone.

This will change our entire industry. Either a company sets up data centers on Mars or they will get replaced by other companies who will set up a data center on Mars.

I think Bitcoin is the same. Bitcoin must also be involved. If Bitcoin cannot get involved then other cryptocurrencies will replace Bitcoin.

It’s very feasible to design other blockchain systems to account for inter-planetary lag. I still want to see Bitcoin become the currency because Satoshi is the most neutral identity. But how to make Bitcoin involved and get consensus within the community is a challenge.

Do you think there will be more Layer 1 blockchains launching in the future?

There will always be Layer 1 blockchains launching but I think most of those launching have no idea why they do it.

To me, making a new layer one successful is very, very hard. To compare, Bitcoin and Ethereum are like Android or IOS — and so launching a new layer 1 project is much like launching a new mobile OS to compete with Android or IOS. Not even Microsoft can do it because there’s a whole bunch of ecosystems behind Android and IOS. Unless you have a very good idea and you are prepared to fail, I don’t think it’s a good idea to launch a new layer 1.

What are the most interesting projects for crypto layer 1 blockchain in the market for you right now?

I’m all in on Ethereum. Ethereum PoS is the most interesting thing we are following and, I must say, we are all in.

I don’t think anything else beyond this attracts me that much.

What is life like for you running one of the biggest Bitcoin mining pools and simultaneously one of the biggest staking provider services?

I used to spend a lot of time on the mining pool because, you know, I’m a Bitcoin believer. But, these days, like I mentioned, after the extreme PoS transition I think stakefish will probably be worth more than F2Pool.

I must also say, stakefish has a far better team compared to F2Pool.

Even after working for years to decentralize that company, it’s still very Chinese — even I have a kind of difficulty communicating with the people over there. I think it’s probably wiser to invest time in stakefish.

I think stakefish, over time, will be a great company and a great team because we have the root of decentralization and diversity in our culture — and we are mostly crypto believers. I do think stakefish will be great.

How do you organize the team? What is it like working at stakefish?

I kind of answered this question early but with F2Pool. “F” is for “fish” so we are also known as a fish pool, and our logo is a fish. That’s where the fish name comes from.

In the beginning, I executed a domain name for bit.fish and we didn’t know what to do with it — but eventually we found staking. That’s why we renamed ourselves from bit.fish to stakefish in 2019. I think we’ll probably stay focused on staking.

To me, it’s a very similar thing that F2Pool is doing. Both mining and staking are to secure the blockchain and generate new coins. We are serving like a money printer to fiat.

On the other hand, we are working on the lower level. It’s up to us to connect to p2p, the real p2p network of different blockchains. That’s very different from other products such as DeFi, NFTs, and higher-level application-level things. Without DeFi, blockchain would still exist but without block producers, blockchain will stop working.

I think that’s our responsibility. It’s something very important to both PoW and people’s PoS and to Bitcoin, Ethereum, and other cryptocurrencies. It’s a huge responsibility. The security of Bitcoin and other blockchains must be in the hands of good people and if not, then you’ll see all the accent on top could be at risk.

How did you come up with grant.fish?

The story of grant.fish goes along with how we started. When we started in 2018 we didn’t know what to do. I had the idea of staking in mind as far back as 2017 after talking with the Ethereum people but I generally didn’t know what to do — and we kind of viewed making something profit-seeking as shameful. We only had a complete idea of how to contribute to the community — that’s the idea of where it comes from. It’s a set project.

These days, we contribute to other projects, such as dogecoin. We secretly operate a website for dogecoin called dogecoin.org and make movies for dogecoin, for example. We also contribute to Gitcoin and, you know, that’s something that isn’t directly related to profit.

I must say, today, we are break-even, only because of the bull market and probably, partially because we never think about how to make a profit. We just do it and don’t think too much beyond that.

If you make something, like a goal, to be the world’s wealthiest person, you most likely won’t be that. So, the goal for us is to just do something, try to get it done, and don’t think too much beyond that.

What is your take on the recent consolidation in the staking business? Staked bought by Kraken, Bison Trails by Coinbase, etc. Do you think this trend will continue?

Let me tell you some history.

At the beginning of F2Pool, it was 2013, we saw DeepBit and GHash.io. They were giant. At one point GHash.io even took 40% of the Bitcoin network hash rate and some people thought it was the end of the world. We also saw Bitmain’s AntPool, btc.com, and other mining pools. At the end of the day these competitors have disappeared or they are gone.

That’s my understanding of last summer (2021).

stakefish doesn’t have a plan to sell to big bodies and I think the community needs the independent staking provider. We just do what we believe and try not to think too much. It’s more inward-looking compared to always looking at and copying competitors. Our competitors always copy from us.

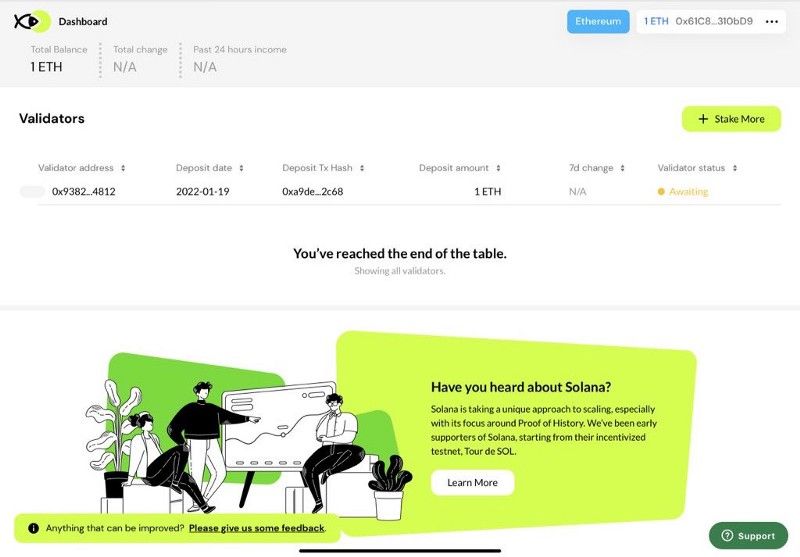

Talk to us a bit through your recently launched Ethereum 2.0 staking service. How does it differentiate from other solutions in the market?

Compared to Lido and RocketPool we operate at a much lower level. We are trying to only add a thin layer on top of the original Ethereum staking protocol. I think that’s the difference. We’ll keep working on the infrastructure level — that is stakefish.

I think next we will make the service much better from a design perspective. We’re also trying to unify a whole bunch — you can create a validator, you can stake with as little as 0.1 ETH, and I think later we’ll make a unified dashboard so people can do both in the user interface. That’s the plan for the first half of 2022. Hopefully we can get it done.

How will that evolve with the merge?

I think when the merge happens we will see real transactions. From our mining experience, MEV (miner extractable value) has played a major role in that of block production. As a staking provider, we must also invest some of our effort into MEV. It’s a big challenge to do this in the right way. It has a big impact on how validators are validating performance.

There are some plans from Ethereum developers to separate block productiion with a block assembler. We are very closely following what we can do and how it impacts our service.

What is your take on the Ethereum staking market? Will it be an entirely liquid staking market and what will the market share composition look like?

I think, unfortunately, things will become more centralized. It’s already very centralized, the biggest player has almost 10%.

I only hope that we will see those that control the majority be similar to that of what we’ve seen from Bitcoin — DeepBit, GHash.io, Bitmain.

I must say, stakefish is here to guard the decentralization of Ethereum and other blockchains. We will never try to be the majority.

I want the whole Ethereum ecosystem to be healthy.

What are other exciting things that you are currently working on and exciting things on your roadmap?

I think we should next invest effort into different networks and how they actually work.

There’s a lot of data involved and we need to look into all of this data. There are a huge amount of tasks on our backlog. What’s blocking our process so far is that we have a very limited team. It’s not big enough so we have very limited resources.

For the same reasons, we are actively hiring and always hiring talent. We have an aim to provide more and make it more data incentivized. This is what we’re going to do in the next year.

If you are interested in learning more about who we are and seeing the open positions at stakefish, head over to stake.fish/jobs/. We would love to hear from you.

How will DeFi evolve? Will you see more institutions joining this market?

I mentioned that I only stake 30% of my portfolio — that means I stake like almost 100%. Of my liquid portfolio, the other 70% is Bitcoin and I cannot stake it.

Infrastructure staking is different from DeFi staking. On the other hand, they also compete with each other. Say some DeFi product offered you 10% APY but infrastructure staking can only offer you 5% — then you have a choice: should I stake my token with a DeFi project or should I stake with Beacon chain.

But, you also need to take risks into consideration.

There’s a chance a DeFi project goes wrong and there’s almost zero chance we’ll see another down event on Ethereum. We probably wouldn’t see an Ethereum drawback because of this. We also have some serious background with Beacon chain and we’ll have to fix it.

So, the risk is different. If you are like, a big whale you will probably feel more comfortable staking ETH on Beacon chain compared to random DeFi projects, despite them being able to give you a far better APY or profit.

Staking with stakefish, because we are working on a lower level there is a lower chance of something with our service going wrong. If you’re staking with some other ETH staking services, such as a higher-level DeFi product, then there is a risk on the smart contract level. That’s why stakefish is different from other Ethereum staking services.

With your experience from PoW, is MEV something you consider for stakefish as a potential business model?

It’s very important to the profit but I think someday you will see it probably separated from block production. I think it’s something that will probably happen. Obviously, with people like Vitalik, they think very hard about how to kick us out of the business, just like how he did to PoW miners. I think if that happens it will only make the ecosystem more interesting.

It doesn’t mean we can only operate on block production, but what we can do is also operate other block creation, block assembly, and further divide these few rules on the blockchain that only makes the whole thing more mature, more secure, and more decentralized. It’s a good and interesting thing to see.

The most interesting thing about Ethereum is that the people are always trying to make it fair for all the miners. If you see what happened with EIIP 1559 we were probably the only major mining pool that supported that. It doesn’t matter what miners say. We knew that and we think it’s a good thing for the whole ecosystem. That’s why we supported it - because even if we didn’t it would still happen.

Maybe someday, staking pools and staking providers will also be targeted by Ethereum and I think that only makes Ethereum a better blockchain. If it’s a good thing for the whole ecosystem we will definitely support the approach.

Follow Chun Wang @satofishi, stakefish at @stakefish, and Staking Rewards @stakingrewards for more.

Watch the full, unedited interview with stakefish CEO Chun Wang and Staking Rewards on Youtube.

Happy Staking!

About stakefish

stakefish is the leading validator for Proof of Stake blockchains. With support for 20+ networks, our mission is to secure and contribute to this exciting new ecosystem while enabling our users to stake with confidence. Because our nodes and our team are globally distributed, we are able to maintain 24-hour coverage.

Website: https://stake.fish

Telegram: https://t.me/stakefish

Twitter: https://twitter.com/stakefish

Instagram: https://www.instagram.com/stakedotfish